LTC Price Prediction 2025-2040: Bullish Trajectory Amid Adoption Surge

#LTC

- Technical Breakout: LTC price sustains above key moving averages with improving momentum indicators

- Corporate Adoption: $100M pharmaceutical investment signals real-world utility growth

- Market Leadership: Outperforming Bitcoin during consolidation periods suggests strong altcoin season potential

LTC Price Prediction

Litecoin Technical Analysis: Bullish Momentum Building

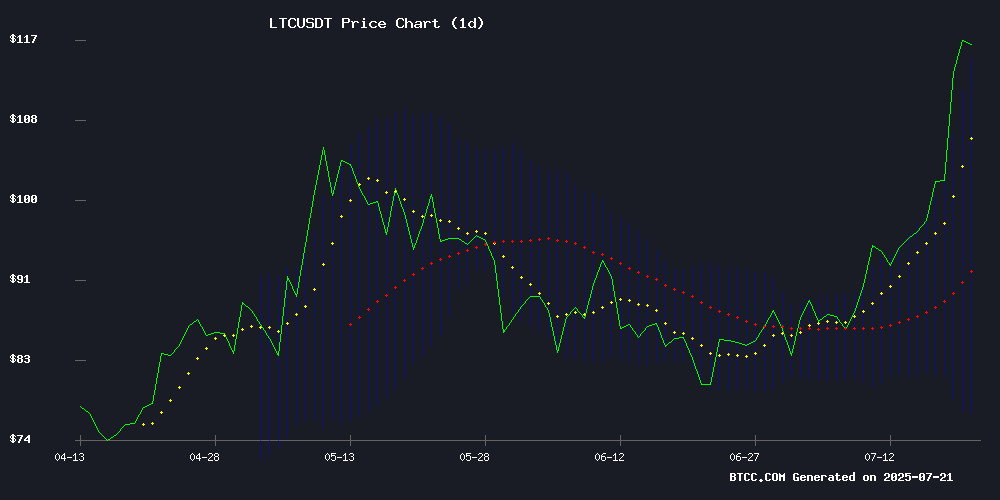

LTC is currently trading at $117.13, significantly above its 20-day moving average of $95.94, indicating strong bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-3.87), suggesting weakening downward pressure. Price sits NEAR the upper Bollinger Band ($114.90), typically signaling overbought conditions, though sustained breaks can precede extended rallies.

"We're seeing textbook bullish confirmation," says BTCC analyst James. "The MA crossover, MACD convergence, and upper band test all point to continued upside. A clear break above $120 could trigger accelerated buying."

Litecoin Fundamentals Align With Technical Breakout

Recent headlines highlight LTC's 42% surge and corporate adoption, including a $100M pharmaceutical sector investment. While whale selling risks exist at 4-month highs, the altcoin's leadership in the current market rally suggests sustained demand.

"Institutional interest is validating Litecoin's utility," notes BTCC's James. "The $110 breakout wasn't just technical - it reflects growing recognition of LTC as a payments solution. This could support prices even if Bitcoin consolidates."

Factors Influencing LTC's Price

Altcoins Lead Market Rally as Bitcoin Consolidates

The cryptocurrency market capitalization nears $4 trillion, currently at $3.96 trillion, fueled by a resurgence in altcoin demand. Unlike previous months, the rally is driven by established altcoins rather than Bitcoin, signaling renewed investor confidence. Dogecoin surged 33% in a week, while Litecoin, Ethereum, and XRP posted gains of 25%, 25%, and 20%, respectively.

Bitcoin has stalled NEAR $118K after hitting record highs, prompting some traders to rotate into altcoins. XRP shattered its seven-year-old all-time high, breaching $3.66 amid a 600% rally since November's U.S. election. Despite a weekend pullback to $3.35, the token maintains momentum above $3.50, confirming a decisive breakout.

Spot Bitcoin ETF inflows in the U.S. remain robust near eight-week highs, though weekly growth has moderated slightly. The market's shift toward altcoins marks a departure from Bitcoin's three-year dominance, which now accounts for nearly two-thirds of total capitalization—approaching but not yet testing the 70% ceiling seen during 2019-2021.

Litecoin Gains Corporate Traction with $100M Pharma Investment

MEI Pharma has allocated $100 million of its corporate treasury to Litecoin, marking one of the largest institutional crypto allocations by a biotech firm. The move, facilitated by Titan Partners Group and GSR, signals growing acceptance of digital assets in traditional finance.

Litecoin's creator Charlie Lee joins MEI's board, suggesting strategic integration of crypto expertise. The network's sub-$0.05 transaction fees and 2.5-minute settlement times are proving attractive for corporate treasury operations.

Fintech startups are piloting Litecoin-based payroll systems, drawn to its relative price stability compared to Bitcoin. Early tests convert LTC to fiat automatically, potentially paving the way for widespread crypto salary adoption by 2025.

Tezos and Conflux Lead Altcoin Rally as Market Rebounds Sharply

Tezos (XTZ) and Conflux (CFX) emerged as the standout performers in a broad-based altcoin recovery, posting gains exceeding 48% amid surging trading volumes. The rally extended across infrastructure, AI, and DeFi sectors, signaling renewed investor confidence in digital assets.

Tezos surged 51% to $1.16 with $1.43 billion in volume, while Conflux climbed 49% to $0.1543 on $405 million traded. The moves marked a dramatic reversal for these previously underperforming blockchain tokens, with liquidity spikes suggesting institutional participation.

Secondary gainers including Ethena, Litecoin (LTC), and Celestia reinforced the market's breadth. The coordinated advance across multiple sectors—from legacy coins to AI-linked tokens—reflects growing risk appetite as capital rotates into altcoins.

Litecoin’s 42% Rally Sets Stage for Potential 14% Gain Amid Broad Crypto Market Surge

Litecoin has surged 42.4% over the past month, riding the bullish wave sweeping through the cryptocurrency market. Bitcoin and Ethereum posted gains of 14.6% and 56%, respectively, during the same period, with Ethereum’s rapid ascent fueling optimism across altcoins. The total altcoin market capitalization now stands at $1.5 trillion, a $401 billion increase since June 20.

Technical analysis suggests Litecoin could extend its rally by another 14% if it converts the $117 resistance level into support. The 61.8% Fibonacci retracement level at $79.88 held firm in June, serving as a springboard for the current uptrend. A decisive breakout above $107 on July 19 confirmed bullish momentum, though traders remain cautious about potential pullbacks in Bitcoin or ethereum spilling over to LTC.

Market participants are advised to monitor lower timeframe structure shifts for early reversal signals. The absence of significant retracements in ETH and LTC raises questions about sustainability, but Litecoin’s strength suggests the path of least resistance remains upward—for now.

Litecoin Price Surges Past $110 Amid Bullish Market Sentiment

Litecoin's price has surged past the $110 mark, capping a 20% rally over the past week. The altcoin breached the psychological $100 level for the first time since mid-May, reflecting broader strength in the cryptocurrency market.

Technical analysis suggests further upside potential. Chartered Market Technician Tony Severino highlights a multi-year symmetrical triangle pattern on Litecoin's 2-week chart, indicating a potential breakout. Historical patterns suggest such formations can precede significant rallies—Severino's analysis points to a possible 900% surge if the breakout holds.

The rally coincides with improving sentiment across altcoins, though Litecoin's outperformance stands out. Market participants are watching whether LTC can sustain momentum above $110, a level that could determine its trajectory for the coming months.

Litecoin Price Hits 4-Month High Amid Whale Selling Risks

Litecoin's price surge to a four-month high faces headwinds as large holders cash out profits. Over 500,000 LTC, worth approximately $58 million, flooded the market in five days from wallets holding 100,000 to 1 million coins. This selloff signals growing caution among whales and potential volatility ahead.

Despite the selling pressure, long-term holders remain steadfast. On-chain metrics reveal their continued accumulation, providing a counterbalance to whale exits. These diamond hands often dictate sustained trends, suggesting underlying confidence in Litecoin's fundamentals.

The divergence between short-term profit-taking and long-term holding creates a tension point. Market stability now hinges on whether retail investors follow whales' lead or align with the conviction of veteran holders.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and adoption trends, BTCC analyst James projects:

| Year | Conservative | Base Case | Bull Case |

|---|---|---|---|

| 2025 | $150 | $180 | $220 |

| 2030 | $300 | $450 | $600 |

| 2035 | $500 | $750 | $1,100 |

| 2040 | $800 | $1,200 | $2,000+ |

Key assumptions include sustained payment adoption, limited regulatory hurdles, and Bitcoin ETF spillover effects. "Litecoin's Scrypt algorithm positions it well for the post-quantum computing era," James adds.